The 2025 Economic Survey released on Tuesday has painted a positive shift in global trade dynamics, which has influenced Kenya’s trade performance in 2024.

Globally, trade volume grew by 3.4 per cent in 2024, rebounding from a 0.7 per cent contraction in 2023, driven by strong performance in business services and tourism.

This global uptick provided a favorable backdrop for Kenya’s trade activities, particularly in its export-oriented sectors.

Kenya’s external sector showed signs of improvement in 2024, with a narrowing trade deficit and a modest rebound in key export sectors.

According to the survey, Kenya’s exports grew by 10.4 per cent to Sh1.11 trillion while imports increased by 3.6 per cent to Sh2.70 trillion.

Kenya’s largest exports were horticulture (Sh203.6 billion), tea (Sh189.1 billion), apparel and clothing (Sh56.8 billion), unroasted coffee (Sh38.4 billion), and animal and vegetable oils (Sh30.3 billion).

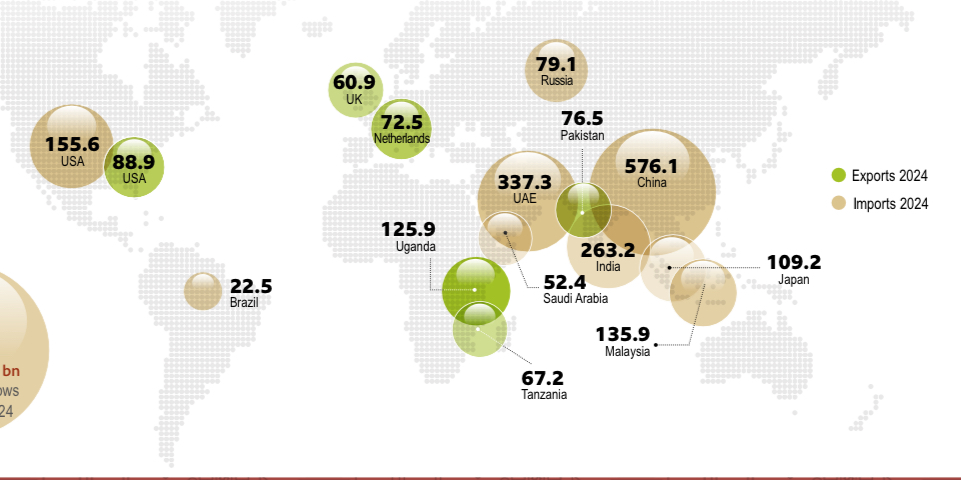

Kenya’s key trading partners for exports in 2024 were Uganda (Sh125.9 billion), the US (Sh88.9 billion), Pakistan (Sh76.5 billion), Netherlands (Sh72.5 billion), Tanzania (Sh67.2 billion) and the UK (Sh60.9 billion).

The top imports to Kenya were petroleum products (Sh552.4 billion), industrial machinery (Sh312.9 billion), animal and vegetable fats and oils (Sh139.2 billion), plastic articles (Sh113.4 billion) and iron & steel (Sh101.8 billion).

Kenya’s imports came from China (Sh576.1 billion), UAE (Sh337.3 billion), India (Sh263.2 billion), the US (Sh155.6 billion), Malaysia (Sh135.9 billion), Japan (109.2 billion), Russia (Sh79.1 billion) and Saudi Arabia (Sh52.4 billion).

Despite the improvement in merchandise trade, Kenya’s current account balance remained in deficit, though slightly improved. Trade balance narrowed from a deficit of Sh 1.60 trillion to Sh1.59 trillion.

At the same time the export-import cover ratio improved from 38.6 per cent to 41.1 per cent. The current account balance improved from a deficit of Sh382.7 billion to Sh208.9 billion.

A key bright spot continues to be diaspora remittances, which have become a vital source of foreign exchange closing the year at Sh674.1 billion.

Kenya has consistently relied on strong inflows from its global diaspora to cushion its balance of payments and support the shilling.

While the narrowing trade deficit in 2024 is a positive development, it masks underlying fragilities in Kenya’s external position.

External debt servicing, exchange rate fluctuations, and a dependency on imports for key sectors such as energy and manufacturing pose ongoing risks.

The government and private sector must invest in expanding high-value exports, reduce overreliance on volatile imports, and capitalise on trade agreements such as the AfCFTA.

Strengthening value chains, improving logistics, and enabling export-led industrialization will be critical to safeguarding the balance of payments and ensuring long-term macroeconomic stability.